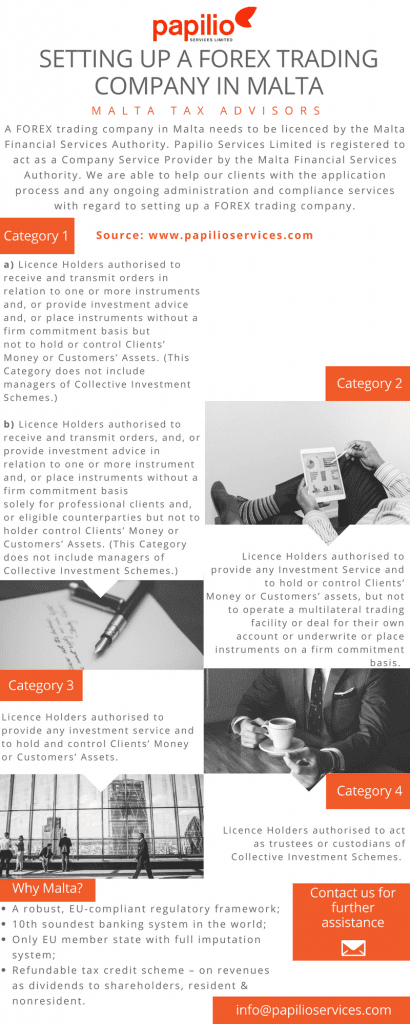

An unconventional asset initially bitcoins were envisaged as an alternative to conventional currencies. Maltas accessible regulator competitive costs and business friendly environment have led it to become an interesting option for forex service providers seeking to work within a well reputed regulatory regime.

Solutions For Smart Traders And Investors Who Want To Pay Less Taxes

Solutions For Smart Traders And Investors Who Want To Pay Less Taxes

Companies are taxed at a rate of 35 per cent.

Forex! trading malta tax. Maltese mfsa regulated forex brokers. Banking financial institutions in malta malta has developed into an international banking centre and accounts for a significant share of global banking activity with more than 25 credit institutions having a presence on the island. Wenn der euro starker wird steigt dann die kaufkraft fur den kauf von dollars.

Forex licensing in trading models trading in contracts for difference derivatives in relation to foreign exchange or rolling spot forex infrom malta. The malta forex industry. Wenn der euro starker wird steigt dann die kaufkraft fur den kauf von dollars.

Forex trading in malta through mfsa forex brokers malta is a member nation of the eu that has a stable political system a sound economy and an excellent environment for businesses to thrive in what is considered to be a promising financial center in europe. Forex trading involves significant risk of loss and ! is not suitable for all investors. Here we will look at the wa! y cryptocurrencies taxes are treated in malta for the purposes of income tax and the reasons a person may invest in cryptocurrency.

Malta is cashing in on its strategic central location and becoming a force to reckon with in the world of financial market trading. Forex trading tax laws in the uk are in line with rules around other instruments despite you buying and selling foreign currency. Ein forex trader wurde in dieser situation dollars verkaufen und euros kaufen.

However if you remain unsure about tax laws surrounding your specific instrument seek professional tax advice. Tax wealth management in malta malta offers a highly efficient fiscal regime which avoids double taxation on taxed company profits distributed as dividends. Spot gold and silver contracts are not subject to regulation under the us.

Advantages Of Estonian Tax System

Advantages Of Estonian Tax System

Tax Tips For The Individual Forex Trader

Tax Tips For The Individual Forex Trader

Is Malta Really Europe S Pirate Base For Tax Bbc News

Is Malta Really Europe S Pirate Base For Tax Bbc News

India Forex Market Ti! mings

Forex Trader Design

Forex Trader Design

Taxation Of Malta Trading Companies Chetcuti Cauchi Malta

Malta Holding Company Altima Malta Limited

Malta Company Formation Malta Limited Company Registration

Malta Company Formation Malta Limited Company Registration

Advantages Of Estonian Tax System

Advantages Of Estonian Tax System

Pakistan Taxes On International Trade Percent Of Revenue

Pakistan Taxes On International Trade Percent Of Revenue

India Forex Market Timings

![]() Forex Brokers Regulations Complete Guide

Forex Brokers Regulations Complete Guide

How To Use An Economic Calendar In Forex Trading

Cryptocurrency Taxes In Malta Bitcoin Trading

Cryptocurrency Taxes In Malta Bitcoin Trading

Taxation In South Africa Wikipedia

Taxation In South Africa Wikipedia